Mortgage Rates Boost Homebuying

May 31, 2024

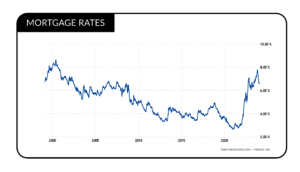

According to Mortgage Daily News, mortgage rates have fluctuated recently. The average rate for a 30-year fixed home loan as of May 27th is 7.08%, down from 7.43% the previous month. The Federal Reserve made efforts to maintain stability and mortgage rates are slowly coming down. Still, Fannie Mae predicts a gradual market improvement in the year ahead despite the upward trend.

30-Year Fixed-Rate Mortgage Rates from 2000-2024

Will Mortgage Rates Come Back Down?

Will Mortgage Rates Come Back Down?

According to economists at Fannie Mae and the Mortgage Bankers Association, rates will come down. It’s just a matter of time. When rates do come down, it will improve affordability for prospective home buyers.

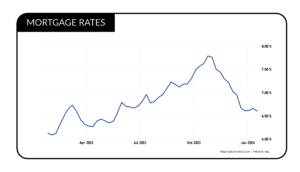

30-Year Fixed-Rate Mortgage Rates from January 2023 – January 2024

Thanks to the recent decline in mortgage rates, Fannie Mae forecasts a gradual but impactful rebound in home sales and mortgage originations in 2024. Since November 2023, purchase mortgage applications have surged by approximately 15%, showcasing a positive trend. Despite this, challenges such as affordability concerns may temper the recovery. Fannie Mae acknowledges the potential for a mild economic downturn in 2024 but maintains a cautiously optimistic outlook for the housing market.

Thanks to the recent decline in mortgage rates, Fannie Mae forecasts a gradual but impactful rebound in home sales and mortgage originations in 2024. Since November 2023, purchase mortgage applications have surged by approximately 15%, showcasing a positive trend. Despite this, challenges such as affordability concerns may temper the recovery. Fannie Mae acknowledges the potential for a mild economic downturn in 2024 but maintains a cautiously optimistic outlook for the housing market.

Seek guidance from us to gain valuable insights into your home search or sale objectives. Discover unique advantages in the current market for special opportunities. Keep in mind that mortgage rates can change swiftly, so stay informed by consulting with your mortgage professional. Connect with us today to make well-informed decisions in your real estate portfolio.